Looking for a Best Instant Loan Apps Without Income Proof in 2025? In this article, we review some of the best instant loan apps in India that don’t ask for salary slips or formal income documents. These apps are helpful if you’re self-employed, a freelancer, or facing an emergency.

Instant loan apps have rapidly gained popularity across India, with more than 10,000 such platforms available today. However, most of these apps require income proof, making it difficult for students or individuals without formal employment to access financial aid. This article explores a curated list of RBI-approved loan apps that either do not require income proof or do not mandate uploading supporting documents.

We’ve tested and compared each app based on:

- Loan approval speed

- Interest rates

- Documents required (or not required!)

- Ease of use

- Hidden charges, if any

Important Note: These loans are meant strictly for emergency needs and not for luxury spending. Always evaluate your repayment ability before taking any loan.

Categories of Instant Loan Apps Without Income Proof

Instant loan apps that don’t require income proof generally fall into two categories:

- For Students – No income required at all.

- Income Required But No Proof Upload Needed – Suitable for individuals with a steady income but without access to formal documentation like salary slips.

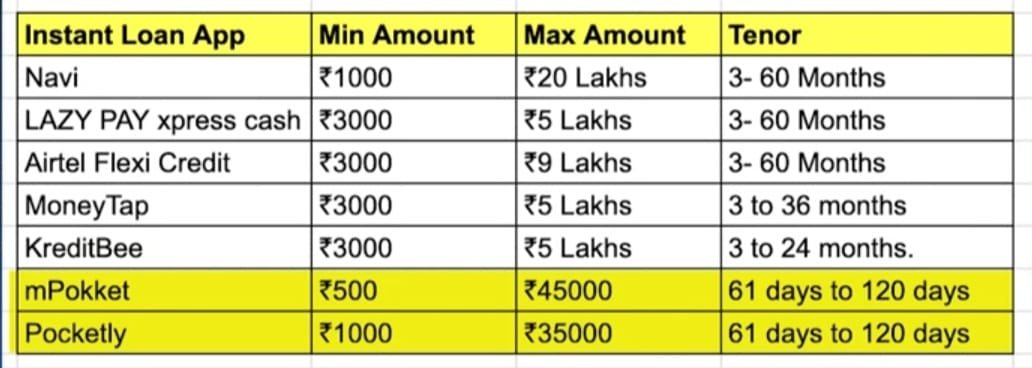

Let’s compare seven popular apps across critical factors such as loan amount, eligibility, interest rate, tenure, fees, disbursement speed, late payment charges, and app ratings.

Loan Amount and Tenure Comparison

The maximum loan amounts offered by these apps vary significantly:

- Highest Loan Amounts: Navi, Airtel Flexi Credit, LazyPay, MoneyTap, and KreditBee – up to ₹5 lakhs.

- Lower Loan Amounts: mPokket and Pocketly – cater mainly to students, offering smaller loan sizes.

Tenure Overview

- Long Tenures: Navi, LazyPay, and Airtel Flexi offer up to 5 years.

- Medium Tenures: MoneyTap (up to 3 years), KreditBee (up to 2 years).

- Short Tenures: mPokket and Pocketly – offer up to 4 months, ideal for short-term student needs.

Interest Rates and Processing Fees

Interest rates among these apps are often presented as broad ranges, lacking full transparency:

- Highest Interest: mPokket and Pocketly – targeted at students with no credit history.

- Lowest or Zero Processing Fees: Navi charges zero processing fees.

- High Processing Fees: KreditBee, Airtel Flexi, and MoneyTap.

Prepayment charges also vary:

- Zero Charges: LazyPay and Pocketly.

- High Charges: mPokket, Airtel Flexi, KreditBee.

Eligibility Criteria

Income Proof Requirements

- No Income Needed: mPokket and Pocketly (for users under the age of 22–23).

- Income Required, No Proof Needed: Navi, LazyPay, Airtel Flexi, KreditBee, MoneyTap.

Age Criteria

- 21+ Years: Navi, LazyPay, Airtel Flexi, KreditBee.

- 23+ Years: MoneyTap.

- Students Below 23: mPokket and Pocketly – no income required.

Credit Score Requirements

- No Credit Score: mPokket and Pocketly accept applicants without any credit history.

- 600–700 CIBIL Score: Acceptable for most apps.

- 750+ Required: Navi prefers high-credit-score individuals.

Minimum Monthly Salary

- ₹1,000: KreditBee, Airtel Flexi.

- ₹25,000: Navi.

- ₹0: LazyPay and MoneyTap accept applicants with no minimum salary condition.

Loan Disbursement Speed

All apps follow an online application and disbursal process:

- Instant Disbursal: Navi, mPokket, LazyPay – funds credited within minutes.

- 1–2 Day Delay: Airtel Flexi, MoneyTap – processing time depends on documentation and credit score.

App Ratings and Market Presence

All listed apps have ratings above 4 stars and a significant number of downloads. Pocketly is relatively new, with slightly lower ratings and downloads. mPokket is available only on Android as of now.

Customer Support Comparison

Responsive customer support is crucial for loan apps, especially due to potential unexpected charges:

- Phone & Email Support: Navi, LazyPay, Airtel Flexi, KreditBee.

- Email-Only Support: mPokket, Pocketly, MoneyTap.

Prefer apps offering both phone and chatbot/email support for quicker resolution of queries.

Choosing the Right Loan App

There is no one-size-fits-all solution. The best app for you depends on your age, income situation, credit score, and urgency of funds. Compare all relevant parameters before applying.

Conclusion: Instant loan apps can be a practical tool in emergencies, especially when traditional banking options are unavailable. However, they should be used cautiously and responsibly. Choose RBI-approved platforms with transparent terms, and always review the fine print before committing.

Need help choosing the right app for your situation? Comment below or reach out — we’re here to guide you!